In its 2020 Finance Law, the French government decided that the electronic invoice would become mandatory for B2B exchanges between French companies. This transition to electronic invoicing will take place gradually from September 2026, and will extend until September 2027, depending on the different sizes of companies.

This reform is based on the establishment of a Public Invoicing Portal (called PPF in France) through which all French invoicing flows will pass. However, the PPF will not accept all types of invoice formats. Only XML UBL, XML CII and Factur-X format will be authorized.

Note that it will be possible to use other formats, such as EDI, if you work with a Partner Dematerialization Platform (PDP). To find out more about the 2024 obligations on e-invoicing and e-reporting, do not hesitate to consult our articles.

Now let’s take a closer look at the Factur-X format.

What is the Factur-X format?

Factur-X is an electronic invoice format. As a reminder, an electronic invoice is an invoice that is created, issued and received in electronic format. A PDF alone is therefore not considered an electronic invoice.

Factur-X was created jointly by France and Germany in 2017. This format makes it possible to meet the requirements of the European semantic standard EN16931 set up by the European Committee for Standardization (CEN). In France, it’s the National Forum for Electronic Invoicing and Electronic Public Procurement (FNFE-MPE) and its German equivalent, the FeRD, which are behind it.

Factur-X: the best of both worlds

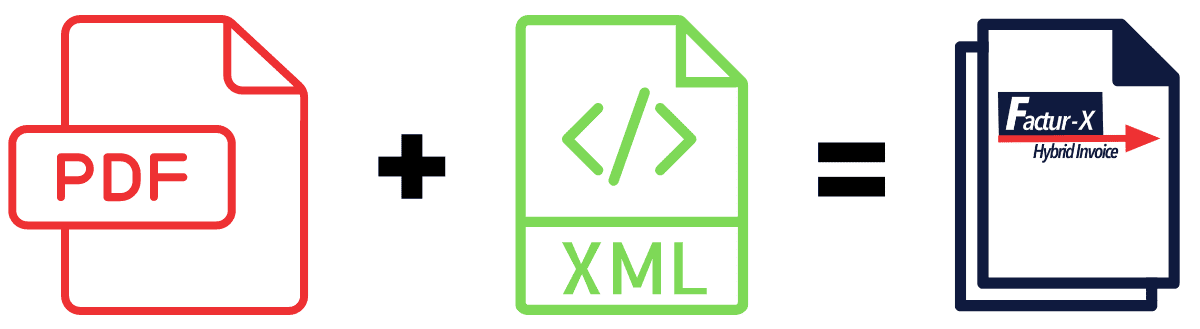

But Factur-X, what is it concretely? It is a PDF/A-3 file, in other words, a “mixed” or “hybrid” format that will combine both a PDF and a structured file. That is to say, this format is composed of:

- an invoice in human-readable PDF format

- an XML structured data file containing the details of the invoice.

The structured part will allow the invoice to be automatically integrated into your management system, such as ERP, or into your accounting software.

Factur-X data profiles

To facilitate the adoption and generalization of this electronic invoice format, different data profiles have been set up to adapt to different sizes of companies:

- MINIMUM: corresponds to the extraction of header and footer data by OCR. This is equivalent to the minimum data requested by the Chorus Pro platform as part of the mandatory electronic invoice for B2G exchanges in France.

- BASIC WL (Without Lines): corresponds to the header and footer data most used by buyers.

- BASIC: adds essential line data to the BASIC WL profile.

- EN 16931: includes all the data listed in the European semantic standard EN16931.

- EXTENDED: corresponds to the previous profile, but takes into account more complex business processes (invoices with several delivery locations, specific payment terms, etc.).

The advantages of the Factur-X format

Clearly, why use Factur-X? The Factur-X invoice format allows automated processing of your invoices. This allows you to reduce the risk of errors and therefore litigation, but also to reduce your administrative costs related to billing management. You save time and can thus concentrate on tasks with higher added value.

In general, you optimize your costs, secure your information and improve your commercial relations.

How to create a Factur-X?

To create a Factur-X, you must now go through a dematerialization service provider such as TX2 CONCEPT, for example. Then, the solution will vary according to your internal capacities.

If you are equipped with a management system and you are able to send us your invoices in the form of structured data. In this case, we translate this data into the Factur-X format. For the legible part of the Factur-X: you can provide us with your PDF template or we can use a generic template.

If you are unable to send us structured data, you send us your invoices in PDF. Using an OCR system, we translate your invoices into Factur-X format. However, this system requires manual re-entry of certain fields which cannot be read correctly.

As part of the 2024 obligations, French companies will also be able to download their PDF invoices one by one on the Public Billing Portal (PPF). The PPF will generate a Factur-X format from their PDF using an OCR system. This system also involves manually re-entering certain fields.

Will the Factur-X format become mandatory from 2024?

The Factur-X format is one of the 3 formats of the mandatory base that will be accepted by the French Public Billing Portal (PPF). The other two being XML UBL and XML CII.

That is to say, it will only be possible to send invoices in one of these three formats to the PPF.

As part of the 2024 obligations, only the profiles below will be authorized for the Factur-X format:

- BASIC WL

- BASIC

- EN 16931

- EXTENDED

Depending on your needs and those of your partners, it may be necessary to opt at least for the BASIC profile which contains the essential line data.

Factur-X: Anticipate the transition to mandatory electronic invoicing

TX2 CONCEPT is PDP, or Partner Dematerialization Platform, for the transition to mandatory electronic invoicing. This means that we will be able to manage all your invoicing flows in the formats expected by the PPF, but also in EDI. You can thus respond positively to all the requests of your clients.

Opting for the Factur-X format today is a relevant and advantageous solution to anticipate the reform on the electronic invoicing obligation. You respond to the current requests of your partners and ensure that you are in compliance for 2024.

To find out more, do not hesitate to reserve a time slot for a telephone meeting with one of our experts.

Book a call