Guarantee of conformity and security for your exchanges.

AP (ex. PDP) e-invoicing at TX2 Concept.

As part of the 2020 and 2024 Finance Acts, the government has decided to make the switch to mantaory electronic invoicing for all VAT-registered businesses from 2026.

The obligation to invoice electronically, or e-invoicing, is accompanied by an obligation to transmit transaction data, known as e-reporting.

The switch to electronic invoicing is an opportunity for companies. The dematerialization of invoices makes it possible to secure and automate processes that are often time-consuming and have little added value.

As an Approved Platform – PA n°15 under reserve, TX2 CONCEPT supports companies with an e-invoicing solution that complies with DGFiP requirements and is tailored to your needs.

We are currently connected to the production of the public platform (called PPF) directory, and are in the process of testing interoperability with other APs and the PPF, covering the entire e-invoicing and e-reporting perimeter. We should receive our final registration by January 2026.

We will then have one year to submit our compliance audit to confirm our registration. We initiated our audit in Q4 2024. For the full list of Approved Platforms, visit the DGFiP website.

Since the summer of 2025, the DGFiP has replaced the name Partner Dematerialization Platform or PDP, with Approved Platform or AP. Similarly, Dematerialization Operators, or DO, are now called Compatible Solutions, or CS. These changes are designed to clarify the positioning and roles of the various players.

Our TX2 Cloud solution ensures compliance with French and international legal requirements. It allows you to globalize the dematerialization of all your invoices.

Benefit from the advantages of electronic invoicing today, and be ready for tomorrow’s regulations!

Our e-invoicing solutions

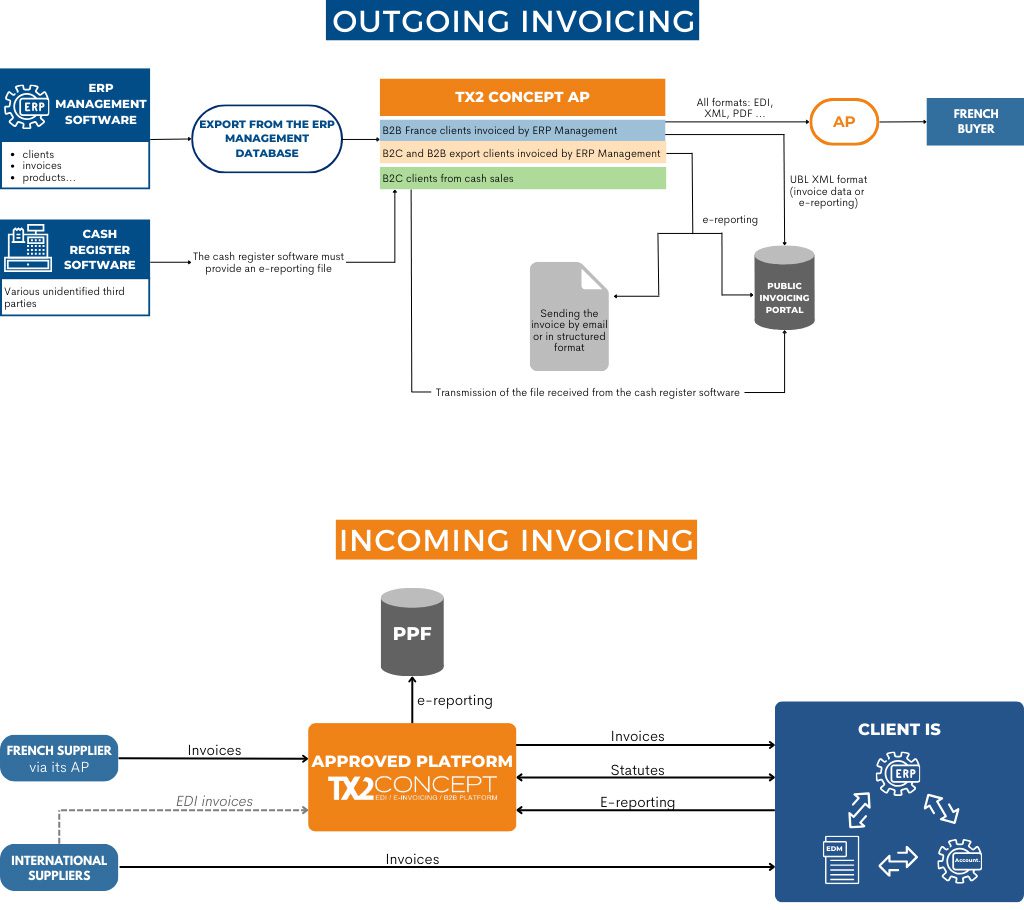

Our solution enables you to dematerialize your outgoing invoices from an EDI or PDF file and send them to your customers via various channels.

With our solution, invoices sent by your suppliers are translated and integrated directly into your ERP or management software, regardless of their format.

Electronic invoicing for whom ?

The switch to electronic invoicing concerns all companies subject to VAT.

We can support you whatever your sector.

How does electronic invoicing with an AP (ex. PDP) work ?

Make sure you comply with the new legal requirements.

Why choose TX2 CONCEPT AP (ex. PDP) ?

25+ years' experience

One of the first providers of tax-compliant invoice dematerialization solutions. Our solutions are certified by specialized firms and GS1.

A complete offer

A complete offer from consulting to integration, with a solution covering all functionalities linked to the 2026 French reform.

Modern tools

Open API-based solution with 3-tier architecture for a secure system. An invoice database based on UBL format.

Functional coverage

A customized functional and service offering (consulting, technical support, use case management, etc.).

Unique platform

Consolidate on on a single platform all your invoicing flows and improve your processes.

Millions of electronic invoices already pass through our platforms, why not yours?

TX2 Cloud AP (ex. PDP) features

Mandatory for all APs

Issuing and receiving invoices to and from APs and the PPF

Compliance checks on invoices and e-reporting

Conversion to base formats (Factur-X, XML UBL and XML CII)

On-time transmission of e-reporting data

Management of mandatory lifecycle statuses

Updating information on the PPF directory

Strong authentication security (MFA)

Included in our offer

Keeping invoices for the legal 10-year period

Provision of APIs enabling any system to use and feed the AP data

Management of all statuses (recommended and optional) and use cases

User management for setting rights on entities or structures

Electronic signature of invoices

Business invoice controls

Secure with EDI mode

Invoice entry and e-reporting module

Optional additional features

Send signed PDF invoices by e-mail

Translation into specific EDI formats: EDIFACT, X12, etc.

AP (ex. PDP) interfaced with EDM-type tools for workflow management

DocuWare EDM integrator

EDI exchanges for all your commercial documents (orders, shipping notices, etc.)

A certified platform.

Guarantees of trust for our customers.

ERP compatibility

Designed to integrate with all management software.

TX2 CONCEPT continually develops and optimizes connectors with all types of management software.

Our technical expertise.

Sector standards and formats

EDIFACT, Odette/VDA, Tradacom, ANSI X12, XML (UBL, CII, etc.), Factur-X, SAP IDOC …

Communication protocols and networks

AS2, OFTP, SFTP, FTPS, HTTP/S, SMTP (e-mail), SAP RFC, Allegro, X400, ENX, OpenText, API …

Tailor-made solutions

We are editor and integrator of our software. This means that we can offer you tailor-made solutions, adapted to your business needs.

Complete offer

We have an offer that covers all of your needs.

Secure data

Your data is stored in France and carefully secured. TX2 Concept is ISO 27001 certified.

Dedicated support

You benefit from a support service available in several languages.

Interoperable solutions

We are signatory to the interoperability charter. This ensures connectivity with your partners.

Project methodology

We rely on the joint application of agile and DevOps methodologies to enable us to achieve our quality and responsiveness objectives.

FAQ.

Who is concerned by the electronic invoicing obligation?

From September 2026, all legal entities and individuals subject to VAT in France will be required to invoice electronically. Don’t hesitate to use the questionnaire provided by the DGFiP. In just 2 minutes, you’ll know how and when you’re affected. If your not from France, you also may be soon concerned by mandatory e-invoicing since lots of countries are having same reforms. TX2 CONCEPT can help you comply with regulations from any country.

What's the difference between e-invoicing and e-reporting?

E-invoicing corresponds to electronic invoicing. In the context of the French reform, e-invoicing applies to exchanges between VAT-registered professionals (B2B exchanges) established in France.

For other transactions, whether with private individuals (B2C) or foreign professionals (international B2B), there is no obligation to issue electronic invoices. However, these transactions do fall within the scope of e-reporting. This involves transmitting certain data on these transactions to the authorities, without having to send an electronic invoice to your customer.

What is an AP (ex. PDP) and what is it used for?

An Approved Platform, AP (ex. PDP) is an electronic invoicing solution registered by the DGFIP.

As part of the reform of the electronic invoicing obligation, the French government is requiring all companies to equip themselves with an AP to exchange their electronic invoices.

Their role is to transmit invoices and invoice data to the public portal (PPF), as well as invoices to your partners’ APs. They guarantee compliance with tax and legal requirements.

Find the full list of APs on the French government website.

What is the timetable for implementing the French electronic invoicing reform?

The reform will be implemented in 2 stages:

- September 1st, 2026: all companies must be able to receive electronic invoices, and large companies and mid-sized companies must issue invoices in electronic format;

- September 1st, 2027: the obligation to issue e-invoices is extended to all French companies.

Are you unsure about your company’s situation? Fill in this 2-minute questionnaire from the DGFIP to find out when and how you are affected.

How do I choose an Approved Platform (AP) for invoicing?

To begin with, you can choose one or more APs. For example, you can have one for incoming invoicing and one for outgoing invoicing. This choice is specific to each company. No AP is imposed.

To start with, take a look at the government’s list of APs to make sure you contact a provider that is indeed an Approved Platform. Perhaps one of your current solutions is on this list?

Draw up a list of criteria according to your needs: management of specific formats (EDIFACT, for example), need to integrate with specific software, workflow management, data security and hosting, SLA, etc. Then compare different solutions according to your criteria.

Then ask for a demonstration of the solutions whose features match your needs.

Shortlist 3 to 5 solutions maximum and ask for a commercial proposal with customer references in your business sector. Based on the above, and on the different pricing and presentation options, you should be able to make your choice of AP.

How do I know if a platform is approved?

It’s very simple: just go to the government website. You’ll find the latest list of Approved Platforms.

To date (10/24/2025), no platform has obtained its final registration. These are reserved registrations. The first definitive registrations should arrive by the end of 2025.

How much does an Approved Platform cost?

At TX2 CONCEPT, for an AP (ex. PDP) electronic invoicing project, we distinguish between 2 costs:

- set-up costs, corresponding to all the services required for the project

- a subscription fee per invoice, decreasing with the volume of invoices.

To find out more, please contact us.

Can I still send paper invoices to certain customers?

You can continue to send paper invoices to your private and foreign customers. At the same time, you will need to declare the payment and transaction data on these transactions, e-reporting, to the PPF via your Approved Platform.

On the other hand, for your customers (French companies), it is not advisable to continue sending paper invoices, as the original invoice will be forwarded by your AP to your customer’s AP and to the PPF.

It may be a good idea to apply e-invoicing to all your invoices, for greater efficiency and traceability.

If I'm not ready in time, what happens?

From September 1st, a taxable person may be penalized for failing to choose a reception platform (Approved Platform, AP).

The taxpayer is liable to a fine of €500, following formal notice to comply within 3 months. In the event of non-compliance, the reform provides for a further fine of €1,000, repeatable every 3 months, following formal notice.